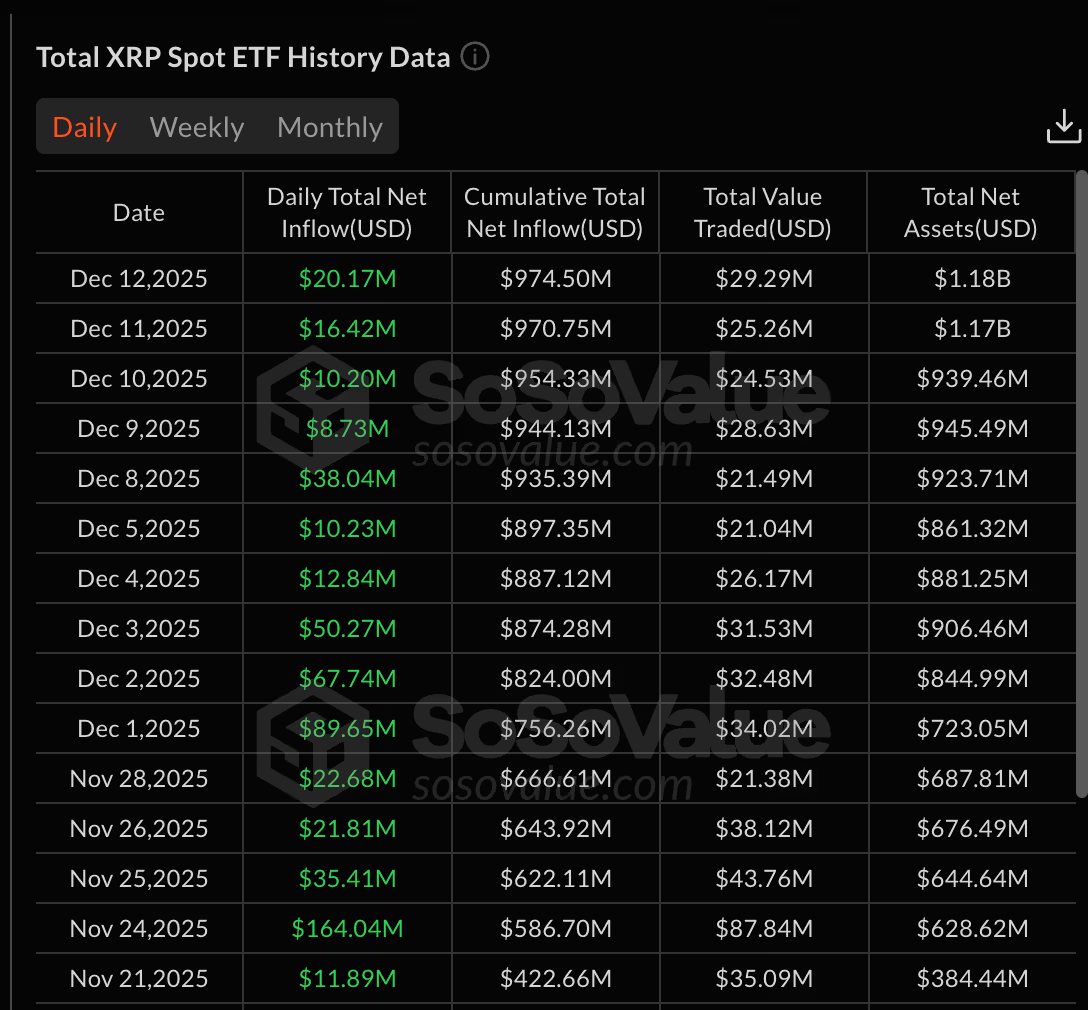

The products have attracted fresh capital every trading day since launch, lifting cumulative net inflows to about $975 million.

What to know:

The uninterrupted streak contrasts sharply with flow patterns in more established crypto ETFs. U.S. spot bitcoin and ether funds — which together account for the bulk of crypto ETF assets — both saw stop-start flows in recent weeks as investors reacted to shifting interest-rate expectations, equity-market volatility and concerns around technology-sector valuations.

U.S.-listed spot XRP $1.9987 exchange-traded funds (ETFs) have recorded 30 consecutive trading days of net inflows since their debut on Nov. 13, setting them apart from bitcoin and ether ETFs that experienced multiple days of outflows over the same period.

Data from SoSoValue shows XRP spot ETFs have attracted fresh capital every trading day since launch, lifting cumulative net inflows to about $975 million as of Dec. 12. Total net assets across the products have climbed to roughly $1.18 billion, with no single session of net redemptions recorded.

XRP-linked products, by comparison, drew steady (albeit much smaller) allocations through the same environment, suggesting demand driven less by short-term macro positioning and more by asset-specific considerations.

The consistency may point to XRP ETFs being used as a structural allocation rather than a tactical trading instrument. While bitcoin ETFs often act as a proxy for broader liquidity conditions, XRP funds appear to be capturing interest from investors seeking differentiated crypto exposure within regulated vehicles.

The flow profile also reflects a broader evolution in the crypto ETF market. Rather than concentrating capital solely in bitcoin and ether, investors are increasingly spreading exposure across alternative assets with clearer use cases in payments and settlement infrastructure.